by Dr. Kate Blaszak

COP28 marks a turning point, not just with its two-thirds plant-based catering announcement, but by placing sustainable food on the formal agenda for the first time. As global leaders prepare for this annual climate discussion, it is crucial to recognise the vast opportunities for a sustainable food future. Renowned for its mixed protein bowl, Asia can lead the way through blended solutions, including preserving traditional plant proteins and scaling alternative proteins, and address the intricate intersection of food security, climate change, and sustainable development.

Investors in Asia’s Protein Transition Platform echo this sentiment, actively supporting collaborative engagement with Asia’s listed food companies toward a 2030 vision[1], goals, and expected disclosure.

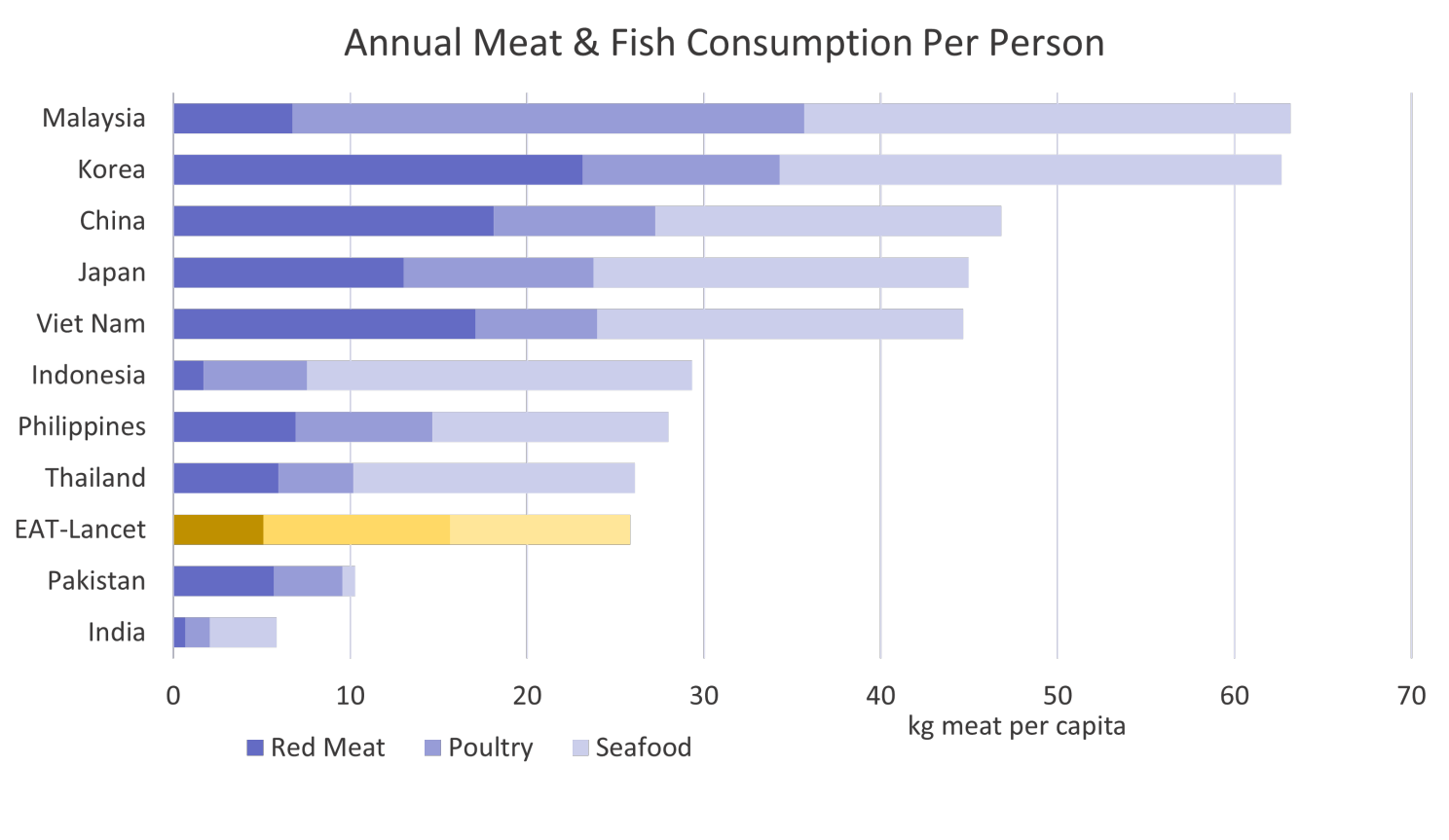

Asia’s rapid rise in intensive farming and animal protein consumption is undeniable. While the USA, Australia, the UK, and Europe have staggeringly high meat and dairy consumption, several East and Southeast Asian nations exceed EAT Lancet Commission recommendations for a balanced, healthy, and sustainable diet. This trajectory poses significant environmental, health, and social challenges, prompting a critical reassessment of industrial protein production.

Against the backdrop of COP28, the food pavilion is scheduled to discuss resilience, finance, smallholders, climate-smart agriculture, regenerative farming, adaptation, and some technical advancements. However, there is no explicit mention of one of the most innovative climate mitigation and adaptation opportunities of this century: alternative proteins.

To stimulate dialogue on this ingenious opportunity, our report, Charting Asia’s Protein Transition, delves into Asia’s ten largest markets, proposing a shift towards alternative proteins alongside other key actions.[2] This strategic move can significantly mitigate industrial animal agriculture’s climate and broader ecological toll ensuring protein security for a growing population. Our projections may seem revolutionary, where, depending on the nation, a minimum of 30% to 90% of alternative proteins are necessary by 2060 for climate safety and protein security.

However, global studies, including the Boston Consulting Group and Blue Horizons, corroborate our findings, with 11% alternative proteins required by 2035 (ARE projected 12% for China). The work of Professor Galina Hale and colleagues on timelines for scaling alternatives further supports the urgency of this transition. Swanson et al summarised the wide-ranging benefits of alternative proteins, from mitigating risks to capturing opportunities, impacting environmental concerns, future pandemics, and antimicrobial resistance.

The Global Innovation Needs Assessment platform also analysed protein diversity globally, discovering potential economic benefits, including new jobs. In Latin America, a collaborative report by the Inter-American Bank and International Labour Organisation projects that transitioning to a net-zero economy and adopting healthier, more sustainable diets could create 19 million jobs in agriculture and plant-based food production. This offsets the 4.3 million jobs likely lost in livestock, poultry, dairy, and fisheries. This dual impact presents an exciting prospect for policymakers and economists addressing multiple major issues.

Asia’s tradition of plant and mixed proteins, coupled with recent expertise, positions the continent as a leader in building a food system that nourishes both people and the planet. Sustainable proteins, encompassing traditional and ‘alternative’ plant-based, fermentation-derived, and cultivated proteins, are not just culinary novelties, but essential components of a resilient food system. Our recent visit to the world’s first commercial cultivated meat facility in Singapore by Esco Aster showcases the potential for a scalable solution, with a waiting list built on rave reviews.

Consumer survey data highlights Asian nations’ willingness to embrace this shift, outpacing major Western counterparts. Countries like China and India show a twofold willingness compared to USA to adopt future cultivated meat. Wealthier and younger generations in Thailand and South Korea already acknowledge the benefits and steer towards plant-based purchases. The Global Food Initiative (GFI) APAC’s nuanced consumer data reveals a promising future, with up to 63% considering regular consumption of plant-based meats. GFI India’s smart protein report speaks to the potential for the world’s most populous nation.

China, India, and Thailand are already producers of raw plant proteins (soy, pea protein, wheat, mung bean, etc.), and these markets, plus Indonesia and the Philippines, have the processing capacity and lower cost context to scale these products. Singapore, Japan, and South Korea also lead in cultivated meat, seafood expertise, and precision fermentation.

Governments are making strides in supporting innovation and upscaling, with notable examples such as Denmark’s plant-based roadmap and Taiwan’s recent climate legislation promoting low-carbon diets, including plant-based options. Along with Singapore, regulatory processes for novel proteins are under development in Japan, South Korea, Thailand, and Malaysia, indicating a region poised for progress. Asia usually excels in the taste, price, and convenience trinity and offers significant potential for hybrid products.

China’s role cannot be understated, not only as a protein production and consumption powerhouse but as an innovative hub for equipment and ingredients essential for scaling alternative proteins. These novel proteins are vital for promoting sustainable, healthy diets ensuring food security, and represent a significant business opportunity. While the Western world relies on major equipment and technical companies, China possesses the capacity and capability to align its own, echoing its successes in electric vehicle production. Synthesis Capital projects a similar global rise of alternative proteins, particularly cultivated products.

While gradual cost and price reductions, problem-solving, and private investment remain encouraging, the current playing field for alternative proteins at scale is neither fair nor favourable. The World Bank released a bold report on destructive subsidies earlier this year, noting collective agriculture subsidies that encourage excessive fertiliser and drive deforestation, could be better used to mitigate climate change. Investment also needs to diversify. Public investment in alternative proteins is a fraction of past investment in renewable energy. Governments need to step up R&D investment, incentives, reorient subsidies, and educate the public about the benefits of adopting a more plant-forward and balanced diet.[3]

Food companies and financial institutions can accelerate this transition by implementing policies, setting targets, and fostering partnerships. Companies can set targets for scaling alternative proteins as part of their integrated climate strategies and implement through partnerships, enabling smarter and cost-effective scale up. Companies can also encourage retail promotion and product placement. Investing in alternative protein research and production drives economic growth and creates opportunities for entrepreneurs, fostering innovation and competition in the food industry. Asian companies hold the potential to lead globally in sustainable protein production, contributing to environmental protection, public health, safety, and economic development.

As COP28 beckons, the question arises: will world leaders adopt a balanced and blended solution supported by science? This inquiry is directed to COP28 and the Food Systems facilitators as they gather for discussions.

Recent global and regional fora on sustainable food systems reveal a stark contrast in narratives. While UN-related events focus on smallholders and ‘sustainable intensification,’ the rise of animal disease and corporate agriculture diminishes the relevance of smallholders as a protein source. The 2023 UN Food System discussions should align with UNEP’s stance, considering how to limit industrial animal production, with alternative proteins as part of the solution. In contrast, the alternative proteins community is confident in its success and future inevitability. From a bird’s eye view, the gap in vision and connection appears immense.

COP28 and its contributors must establish common goals for the greater good, build necessary bridges, and explore all promising options. The event also provides an unparalleled platform for Asian leaders to showcase their strategic commitment to sustainable food with bold, blended solutions, transformative policies, and supportive subsidies. This is not just an opportunity to redefine the protein production and consumption narrative, but a business opportunity to cater to the growing Asian population and beyond. The time for change is now, starting with what we decide to grow and put in our bowls.

COP28 is a call to action, an opportunity for the world’s leaders to build a resilient, responsible, and more sustainable food system that will reverberate on the bowls of billions. By embracing alternative proteins as part of the solution, Asian nations and others can build a food system that nourishes people and the planet for future generations.

[1] The 2030 vision encourages companies towards a more sustainable, just, and compassionate protein future in Asia, aspiring that Asian food companies contribute to regional and global protein security by growing the share of sustainable proteins and limiting the share of animal proteins from industrial farming and fisheries. For complete details, visit https://asiareengage.com/protein-transition/

[2] ARE’s projections for the necessary minimum volume and proportion of alternative proteins are on top of ‘best mitigation’ scenarios applied to conventional animal protein production. A 10-market summary is available at https://asiareengage.com/wp-content/uploads/2023/07/Charting-Asias-Protein-Transition-Ten-Asian-Markets.pdf

[3] For more information, visit the 2023 GFI’s APAC state of the industry report.