Contributed by: Rituj Sahu, Director, Protein Transition, India & Pongsagorn (Art) Satjipanon, Protein Transition Manager, Thailand

When the EAT-Lancet Commission released its updated report in October 2025, much of the global discussion focused on the familiar headline: a predominantly plant-based diet is essential for climate, nature, justice, and health. But buried within the modelling is a deeper, more consequential message that Asia, more than any other region, must take seriously. Food systems alone can push the planet beyond 1.5°C, even if the energy sector decarbonises fully.

The reason is simple and structural; animal protein systems sit at the fulcrum of planetary boundary transgressions, from methane and nitrous oxide emissions to land conversion, nitrogen flows, freshwater stress, deforestation, antimicrobial resistance (AMR), and biodiversity loss. This is not a marginal issue at the edges of the sustainability dialogue. It is a central, quantifiable driver of ecological overshoots. In its report, the Commission notes that seven of nine planetary boundaries are already breached, with food systems responsible for a significant share of pressures across climate, biosphere integrity, freshwater, and nutrient cycles.

EAT-Lancet 2.0 is unambiguous. To remain within a safe operating space, food-system transformation is needed along with major reductions across livestock-related methane, nitrogen losses, land expansion, and antibiotic use. Nutrient flows must be dramatically lowered and AMR risks must be addressed, with animal farming accounting for about 73% of total antibiotics usestil. The report’s updated reference ranges for protein consumption are not just nutrition and health guidelines; they are planetary boundary-aligned guardrails for the transformation of food systems. The Commission has set a target for bringing global food system emissions below 5 gigatons of CO₂e by 2050, less than one-third of today’s levels.

This matters profoundly for Asia. The region’s protein production trajectory has been characterised by rapid and simultaneous expansion, intensification, and structural dependence. India’s dairy and poultry sectors are growing fast and are deeply intertwined with methane emissions, water stress, and antibiotic overuse. China’s caged chicken and high-rise pork systems are among the world’s most nitrogen-intensive, antibiotic and imported feed-dependent. Southeast Asia’s poultry and seafood exporters operate in global supply chains where ecological limits, from fish stocks to land-use constraints, are tightening.

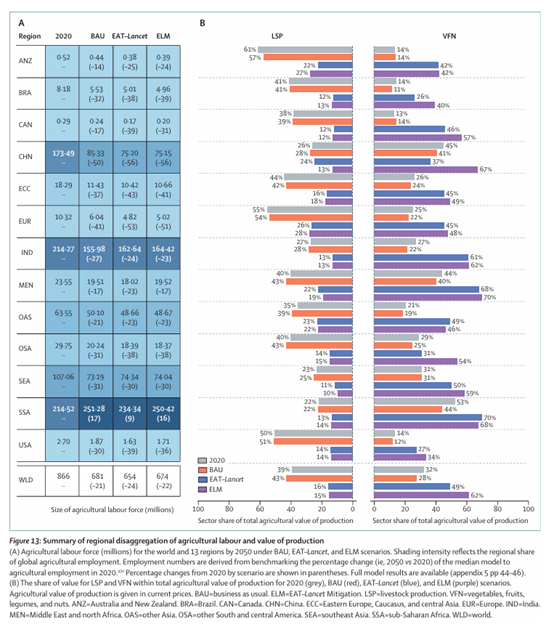

Aggregated, Asia is not just a consumer base; it is a determinant of the global protein pathway. If the region aligns with planetary boundaries, the world has a chance. If it doesn’t, no level of renewable energy deployment will be enough to compensate. The labour transition implications are also important for Asia, underscoring the need for a just transition across all key sectors, along with a major financial pivot

From biology to balance sheets

In 2023, ARE’s Charting Asia’s Protein Transition modelled the emissions problem and solution to business-as-usual protein pathways for Asia’s 10 largest markets, highlighting the essential need to cap industrial farming by around 2030 and grow the production of plant and other proteins, along with a series of other mitigations for animal agriculture.

FAIRR’s recent commentary on the EAT-Lancet report highlighted the need for companies to shift portfolios, support farmers, and increase access to healthy foods. These are all crucial supply- and demand-side steps. However, the EAT-Lancet 2025 science points to a deeper challenge, one that goes beyond corporate pilots or product innovation. Protein transition is now a financial, policy, and governance imperative that spans all breached ecological boundaries.

The financial stakes are high. Food systems already account for USD15 trillion in global annual losses from health and environmental damage, while a boundary-aligned transformation could unlock up to USD5 trillion a year in benefits, according to the Food System Economics Commission.

However, addressing livestock-related methane, nutrient pollution, water scarcity, biosphere impacts, and antibiotic use cannot be achieved through voluntary initiatives alone. They require clear, science-aligned transition policies and plans across protein portfolios, including credible Scope 3 reduction pathways for livestock emissions and scaling plant-proteins, integration of water scarcity, nutrient, and antibiotic-use intensity into materiality assessments, and alignment with wider nature-related risk frameworks. They must also be supported by lending and capital allocation frameworks and deployment that recognise livestock-related risks across climate, nature, and AMR.

Our recent report, Banking Asia’s Protein Transition, outlines specific steps regional banks can take to support this food system transformation by assessing and reducing their exposure and simultaneously supporting the diversification and scaling of plant proteins. Ultimately, financial policy and frameworks must evolve to make protein-related externalities and opportunities visible and decision-relevant, strengthening food and agri company action.

Asia’s emerging sustainability frameworks and corporate governance offer important though nascent openings. India’s BRSR Core and sector-specific KPIs, China’s climate-agriculture strategies, and taxonomy developments in Southeast Asia and elsewhere in the region create opportunities to better align with boundary-informed metrics. These regulatory levers will only shift entire sectors if they move closer to the scientific thresholds highlighted in EAT-Lancet, and if corporate boards are prepared to oversee implementation.

Why investor mobilisation and regulatory alignment matter now

Investors increasingly understand that animal protein is financially material, not just from climate exposure but from ecosystem decline and collapse, negative health impacts, feed volatility, water scarcity, and reputational risks. Yet investor frameworks remain incomplete. Few incorporate quantitative planetary thresholds, and fewer still translate EAT-Lancet’s reference ranges and recommendations into engagement KPIs, portfolio risk assessments, or transition finance strategies.

Bringing science into stewardship requires building a clear investor–corporate–regulator loop, in which science defines the guardrails, investors translate those guardrails into expectations on companies and banks, regulators embed them into disclosure and finance systems, companies align strategies based on these collectively reinforced signals and harness market opportunities and sustainable growth.

Some organisations, including investor engagement platforms operating regionally, have begun serving as translators between planetary science and financial decision-making. But the scale of the challenge requires much broader engagement and alignment.

Asia’s moment of decision

What EAT-Lancet 2.0 makes clear is that Asia’s protein choices are climate choices. Three insights stand out:

- The region cannot rely on energy decarbonisation alone; food system emissions must fall sharply, especially livestock methane and nitrous oxide.

- Protein transition is not synonymous with “veganism”. The science calls for diversified, culturally relevant, boundary-aligned, healthy protein systems that combine responsible animal protein, plant-based proteins, and, in some contexts, sustainably managed aquatic foods.

- Transformation requires systemic levers that reinforce and accelerate corporate action, not replace it. Banks, investors, and regulators must internalise protein-related risks and align capital flows accordingly. Asia has the scale, diversity, and regulatory momentum to lead the next chapter of global food systems transformation. Doing so would not only help restore planetary boundaries, it would strengthen regional climate and corporate resilience, reduce AMR and other health burdens, and future-proof Asian companies in a tightening global transition landscape.

The science is now clearer than ever. The question is whether decision-makers across Asia are ready to treat protein transition with the same seriousness and urgency as the energy transition. The truth is unavoidable: without changing how Asia produces, finances, and governs protein, 1.5°C is completely out of reach.