Contributed by: Mira Cordier, CFA, Research Analyst - Energy Transition

Executive Summary

- Japan has awarded capacity payments to six ammonia co-firing projects through two rounds of its Long-Term Decarbonisation Auction (LTDA) in 2024 and 2025. These projects cover 865.3 MW of capacity across 4.5 GW of coal plants, representing only 15.8% of Japan’s ultra-supercritical (USC) coal fleet.

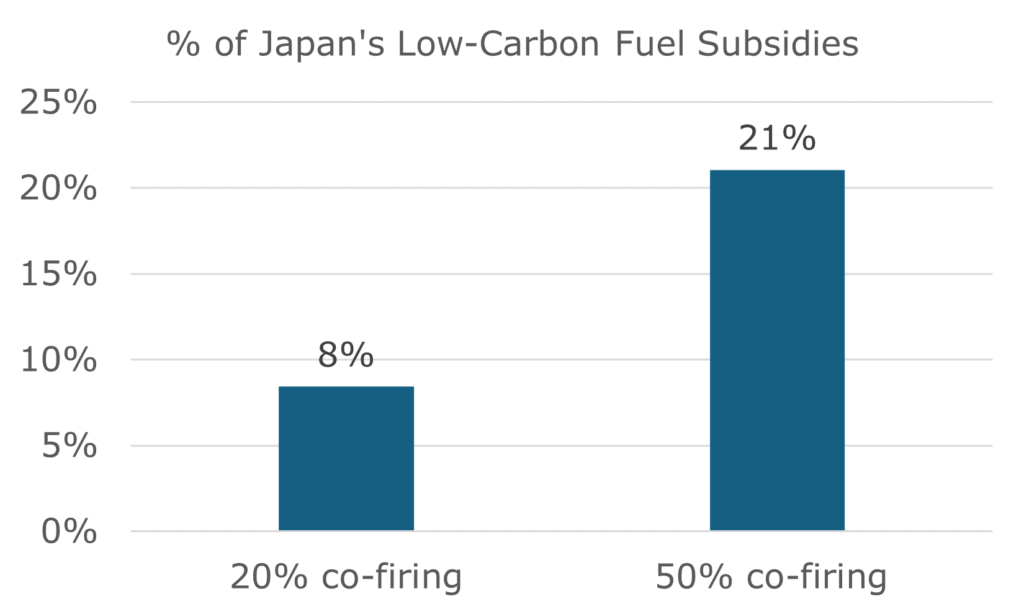

- At a 20% co-firing rate, the projects are estimated to require JPY252.7 billion (USD1.7 billion) in subsidies over 15 years, or 8.4% of Japan’s Hydrogen Society Promotion Act budget for low-carbon transition fuels.

- Scaling to 50% co-firing would raise the subsidy burden to JPY631.6 billion (USD4.2 billion), or 21.1% of the same budget.

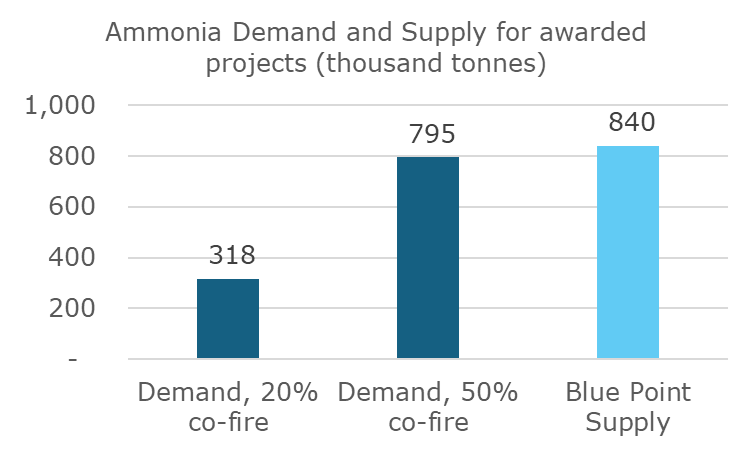

- The Blue Point project in the U.S. – the only large-scale blue ammonia supply source with Japanese equity participation – could meet the ammonia demands of the projects awarded under the LTDA. If those coal plants scaled up to 50% co-firing, the Japan-linked supply from that project would need to be fully dedicated to these few units.

- Considering the high costs for only a limited portion of the USC fleet, the minimal emissions reduction impact at 20% co-firing, and the uncertain feasibility of scaling to 50%, this strategy risks becoming a costly dead end.

Following the April publication of our report (subsequently updated in June) on the financial unviability of ammonia co-firing in Japan’s coal power plants, and a June op-ed highlighting market and policy developments that further challenge its prospects, we believe it is timely to revisit the economics of co-firing in light of recent LTDA outcomes.

This comes as the government prepares to allocate Contracts for Difference (CfD) subsidies to support selected ammonia co-firing projects under its Hydrogen Society Promotion Act.

Awarded Projects and Capacity Overview

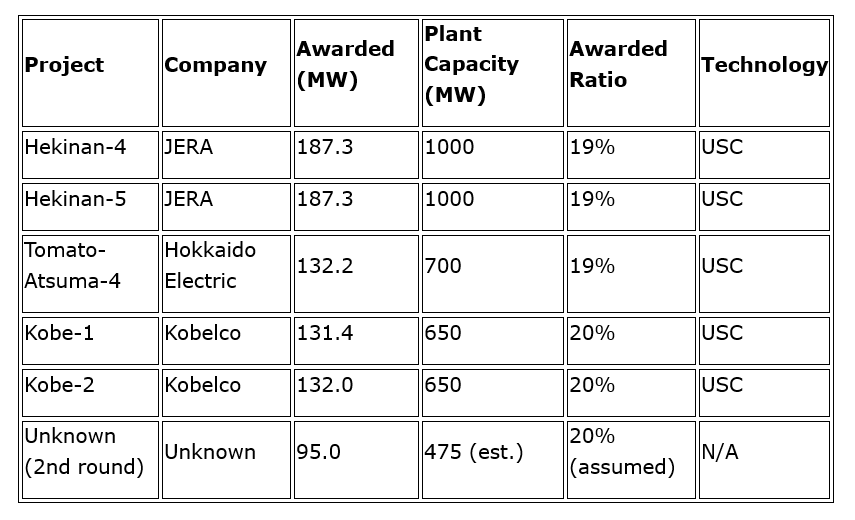

Japan’s LTDA mechanism awards 20-year capacity payments to eligible low-carbon power projects. To date, six ammonia co-firing projects have been selected – five in the first auction round, one in the second – receiving awards for 865.3 MW, tied to 4,475 MW of total coal plant capacity. This means only around 19% of the installed capacity at these plants will be “decarbonised” at a 20% co-firing rate.

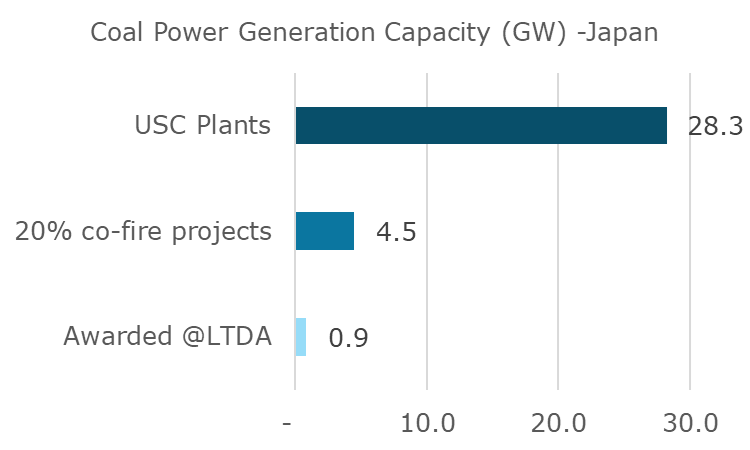

More broadly, these six projects account for just 15.8% of Japan’s USC coal capacity [1]. At a 20% co-firing rate, they will decarbonise less than 1 GW of USC capacity.

Figure 1: Awarded capacity is only a fraction of Japan’s total USC fleet

Figure 2: Ammonia co-firing projects with awarded capacity

Source: OCCTO, ARE.

Ammonia Demand and Subsidies Needed

Using our previously established assumptions (coal at USD150/tonne and blue ammonia at USD500/tonne) and assuming 50% plant utilisation, we estimate the six awarded projects will require approximately 317,866 tonnes of ammonia annually at a 20% co-firing rate.

Over 15 years, this would equate to JPY252.7 billion (USD1.7 billion) in CfD subsidies – or 8.4% of Japan’s JPY3 trillion budget for low-carbon fuels.

At 50% co-firing, annual ammonia demand would climb to 794,664 tonnes and the subsidy burden jump to JPY631.6 billion (USD4.17 billion) over 15 years, equivalent to 21.1% of the CfD budget.

Figure 3: Ammonia subsidies for awarded projects account for a large part of the country’s low-carbon fuel budget.

Source: ARE

Supply Outlook for Blue Ammonia

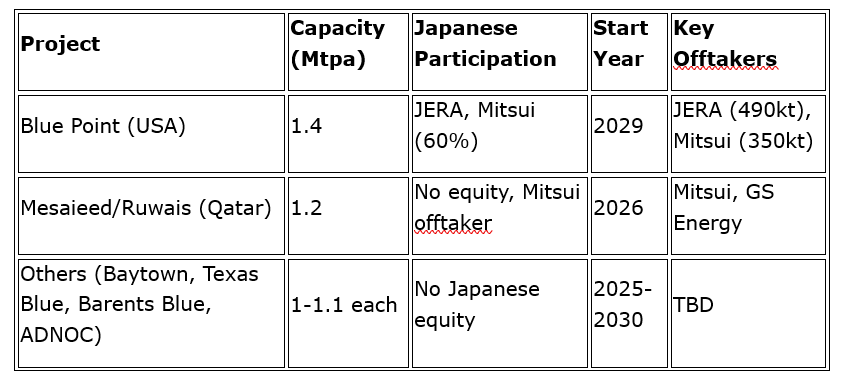

Among large-scale blue ammonia projects worldwide, Blue Point in the U.S. is the only one with partial Japanese ownership that has reach a final investment decision. Jointly owned by JERA and Mitsui, which hold a combined 60% stake, the project has a total capacity of 1.4 million tonnes per annum (Mtpa) and is slated to begin operations in 2029.

The Mesaieed/Ruwais project in Qatar may begin supplying blue ammonia for Japan’s needs as early as 2026. Mitsui has secured offtake agreements but specific volumes have not been disclosed.

Notably, if the LTDA-awarded projects shift to 50% co-firing, then almost all of Blue Point’s Japan-linked production capacity would need to be allocated to these units, assuming they function as grid-balancing power generators at around 50% capacity.

Figure 4: Ammonia demand from awarded projects vs. supply

Source: ARE.

Figure 5: Large-scale blue ammonia production projects announced

Conclusion

Japan could end up spending 8.4% of its total low-carbon fuel subsidy pool on co-firing at just six coal plants, which collectively represent only 15.8% of its USC fleet and, at a 20% co-firing rate, achieve minimal emissions reductions.

If scaled to 50% co-firing, these same projects could absorb more than 21% of Japan’s CfD budget, yet the technology is still under development and commercial viability remains uncertain.

With the government aiming to finalise ammonia CfD subsidy allocations by March 31, 2026, policymakers face a critical decision: whether to continue backing a high-cost, low-impact strategy or to redirect public funds toward more scalable and effective decarbonisation pathways.

References:

[1] https://beyond-coal.jp/beyond-coal/wp-content/uploads/2025/04/JBC-data-for-summary-2_202504R_en.pdf