by Kurt Metzger

There was a significant step forward at COP28 where participants agreed to pivotal language [1] to steer away from fossil fuels and achieve net zero by 2050. But the communique also features a step backward in acknowledging a role for transitional fuels in facilitating the energy transition and ensuring energy security.

The term “transitional fuels” in the COP28 text refers to fossil gas, natural gas, and liquefied natural gas (LNG). This inclusion marks a significant victory for the gas industry, especially proponents of LNG. However, the expansion of LNG production and associated infrastructure as a pathway to reduce greenhouse gas (GHG) emissions in this critical decade is not supported by current science.

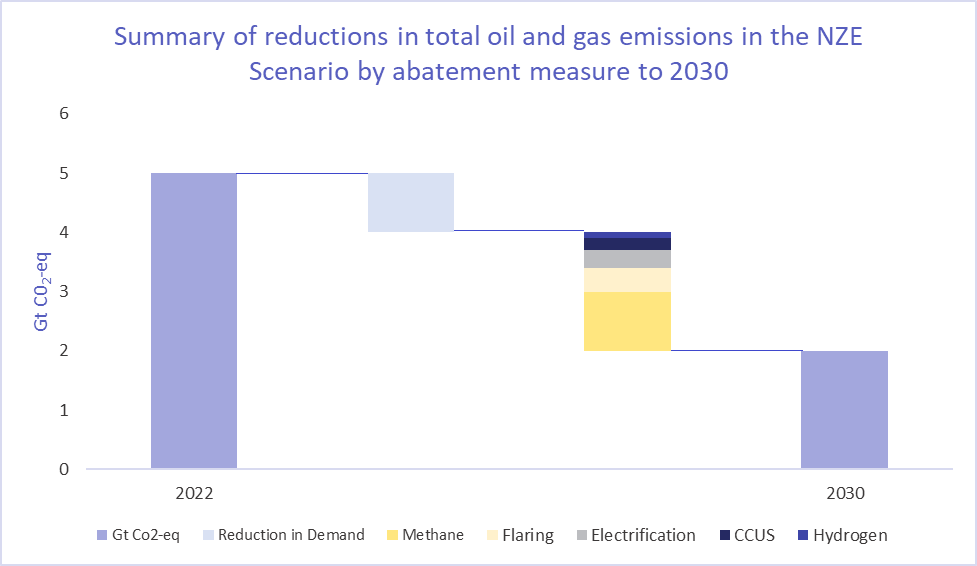

The International Energy Agency (IEA) released a special report on oil and gas emissions at COP 28. The report emphasises that total emissions from the gas industry must be reduced by 65% and emission intensity by 55% by 2030. IEA estimates that 30% of the emission reduction will need to come from reduced demand/production with much of the balance from investment in technology to reduce methane leakage and flaring. This scenario contrasts with industry growth projections.

Shell’s figures released in 2023 show a projected increase in LNG supply from the current 400 million metric tons per annum (MTPA) to 520 MTPA by 2030. Shell’s data on LNG supply under construction predicts that 50% of the increased capacity will come from the USA and Canada, with most new investments originating in the USA. Qatar is expected to contribute the remaining balance through the North Field East Expansion.

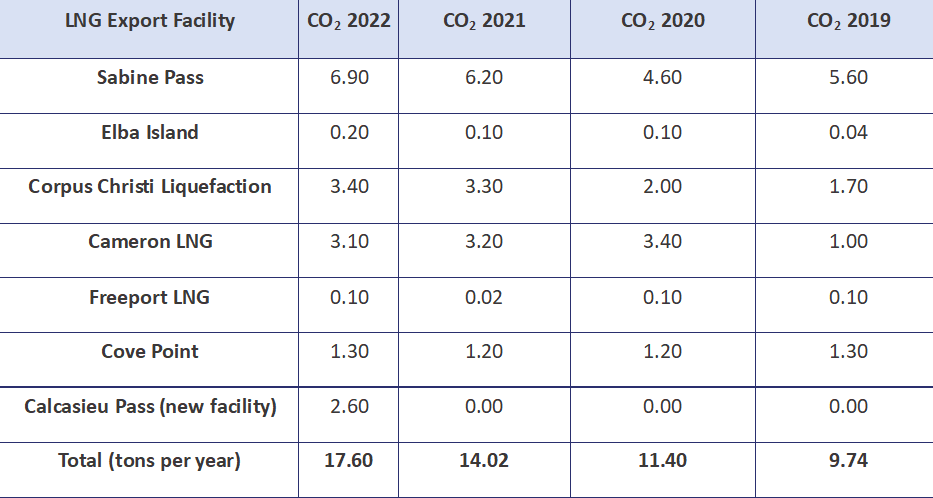

The USA only began exporting LNG in 2016, and the carbon footprint of export facilities is now under scrutiny. The U.S. Environmental Protection Agency (EPA) data reveals that carbon dioxide (C0₂) emissions from all seven operating U.S. LNG export facilities reached 17.6 million tons in 2022, marking an 81% increase since 2019 when there were only six facilities.

CO₂ pollution surges at US export LNG terminals

According to Reuters, projections from companies suggest that as five US projects currently under construction come online by 2028, they will contribute an additional 27 million tons of CO₂ emissions annually. This projection translates to a cumulative total exceeding 45 million tons per year by the end of the decade. These estimates are based on data provided to both the EPA and the Federal Energy Regulatory Commission (FERC).

Beyond CO₂ emissions, new research into the life cycle emissions for LNG, including from the Rocky Mountain Institute (RMI) and Cornell University, suggests that methane leakage can eliminate any carbon advantage LNG may have over coal. RMI’s study last July concluded that methane leakage rates as low as 0.2% would result in lifecycle greenhouse gas emissions from natural gas at a similar amount to those emitted by coal-fired energy.

In November 2023, Robert Howarth from Cornell University highlighted that LNG exported from the USA to Asia or Europe may have higher carbon intensity than local coal use due to methane leakage throughout the LNG supply chain, particularly during shipping. Howarth noted; “While some proponents of LNG have argued it has a climate benefit by replacing coal, the analysis presented here disproves this. Across all scenarios considered, total greenhouse gas emissions from LNG are larger than those from coal, ranging from 24% to 274% greater”. The research estimates the final-combustion emissions at the power plant using the LNG as fuel only comprise 23% to 37% of total greenhouse gas emissions when calculated based on life cycle emissions.

The U.S. Department of Energy (DOE) will soon need to make an important decision on whether to grant a license to Venture Global’s Calcasieu Pass 2 (CP2) LNG project in Louisiana. This $13 billion project, with the potential to export a quarter of the current global LNG supply, is part of the most substantial buildout of LNG infrastructure globally. If the project goes ahead this will have a significant impact on the USA’s ability to meet its Paris Agreement obligations.

As governments navigate the challenges posed by the LNG industry’s expansion, it is critical to reevaluate their approach. ARE’s latest LNG report recommends a thorough review of energy policies, enhanced emissions monitoring, and increased investments in renewables. Additionally, a reassessment of financial institutions’ lending policies is essential to align with global net-zero objectives. The time has come for a recalibration of our energy strategies to ensure a sustainable and responsible transition to a low-carbon future.

[1] The final text from COP 28 includes “transitioning away from fossil fuels in energy systems, in a just, orderly and equitable manner, accelerating action in this critical decade, so as to achieve net zero by 2050 in keeping with the science”. The next paragraph, however, starts with “recognizes that transitional fuels can play a role in facilitating the energy transition while ensuring energy security”.

ARE aims to catalyse corporate change through investor-backed engagement to cultivate a sustainable and compassionate Asia.

Our pioneering approach fills an engagement gap by bringing leading investors into dialogue with Asian-listed companies to address sustainable development challenges. Our high-quality independent research, robust investor network, and engagement expertise, provide corporate leaders and financial decision makers with insights leading to concrete action.

Explore more of our work, including our latest publications here.